Before starting my own journey into private practice, I asked my friends and colleagues who had opened private practices of their own how much money I needed to get started. The number that most of them told me was $300,000. I kept this number in mind when I started drafting the business plan that I would use to apply for a small business loan.

When I researched small business loans, I wanted to choose a lender that understood the unique challenges and needs of owning and operating a private medical practice. Any big bank would likely drool at the chance to fund an upstart private practice since doctors are seen as high-earners and able to reliably pay off the loan, sink or swim. However, only two banks offer lending products specifically for healthcare providers: Wells Fargo and US Bank.

After spending months writing up and editing my business plan, I scheduled meetings with both of these banks but had very different experiences with each. I planned to meet with US Bank first, but they forgot about our meeting when I showed up to their local branch. This poor first-impression was lasting for me, and I decided I didn’t want to reschedule with them.

My experience with Wells Fargo Practice Finance division was quite the opposite. My initial meeting took place with the Business Development Manager and associates, whose focus was in healthcare. They were warm in their welcome, went over my business plan with me, asked important questions, and gave me advice on how to get started. Then, they detailed everything I would need to formally apply for the loan. The initial application required the following documents:

- Practice Start-Up Information – details about my proposed private practice (i.e. square-footage, location, payer demographics, staff)

- Personal Financial Statement – details about my personal assets and liabilities (i.e. cash, debt, property ownership)

- Credit Application – credit check

- Beneficial Statement of Ownership – details about my business entity (i.e. S-corporation name, address, EIN)

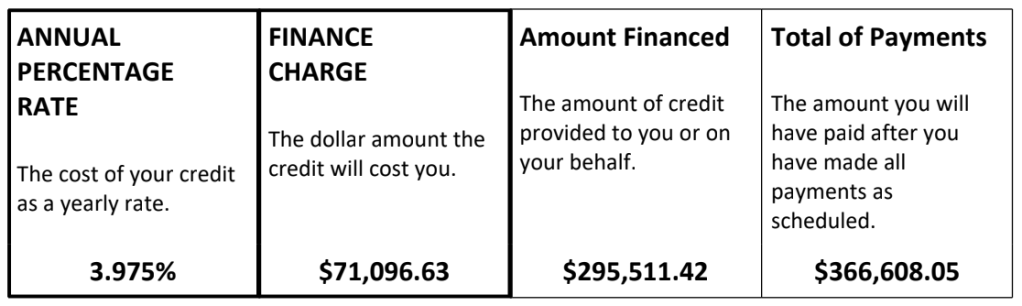

After providing the Wells Fargo practice finance team with additional documents, such as proof of various insurance policies (i.e. life, disability, malpractice, liability, worker’s compensation), I worked with them to breakdown how I would use the funds to pay for rent, specific equipment, salaries, etc. Within two months of starting the application process in January 2021, I was awarded a nearly $300,000 loan with a 10-year term and fixed interest rate of 3.975%.

This loan not only paid for all of the equipment I needed to examine and perform procedures on patients starting day one, but covered all my monthly overhead for almost the entire first year of my private practice’s existence. It allowed me to grow the business without the pressure of needing to be profitable right away. By simultaneously earning money through my work doing anesthesiology and qualified medical evaluator (QME) exams, I was able to comfortably ramp up the clinic volume to a point where I could focus more time and energy on the private practice. As planned, I am now in the fortunate position to start paying off the loan while continuing to grow the practice.

Leave a comment