-

Dropped My EHR for Google Workspace

When I opened my practice in 2021, I checked out a couple of different cloud-based electronic health record (EHR) systems: DrChrono, Athena, and Modernizing Medicine. I ended up choosing DrChrono, which is easy to use and feature-rich.

However, my practice has evolved over the past 3 years, and despite DrChrono already being a very lean and nimble EHR, I found a lot of it’s functionality to be unnecessary for my purposes since I am a solo-practitioner and only see patients who pay out-of-pocket, or who are involved in personal injury claims.

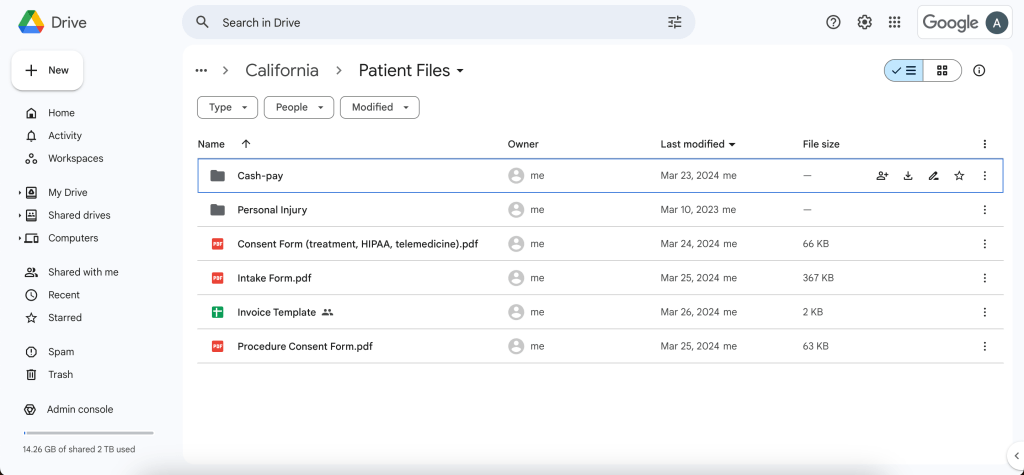

I already use Gmail as the nexus for all of my communication with patients, attorneys, case managers, etc. and so the realization that I could also use Google as a HIPAA-compliant system for scheduling, record keeping, billing, and form creation for much cheaper made the transition a no-brainer. DrChrono costs $600 per month for one user, and Google Workspace with Gemini costs about $32 per month for one user – 5% of the cost of DrChrono.

View of my Google Workspace. Moving from a “traditional” EHR to Google Workspace is significantly reducing my monthly overhead, and saving me money that I can pour into other aspects of my business to help it grow. Moreover, the potential of using Gemini for tasks currently handled by a medical assistant hints at further cost-saving opportunities. If you are interested in making the transition, do the following:

- Open a Google Workspace account

- Sign the Google “Business Associated Agreement (BAA)” to ensure HIPAA-compliance

From here, take your time creating and organizing your calendar, folders and files, note templates, etc. It is definitely a process, but it’s worth it!

-

Competitive analysis using Google Maps and CMS data

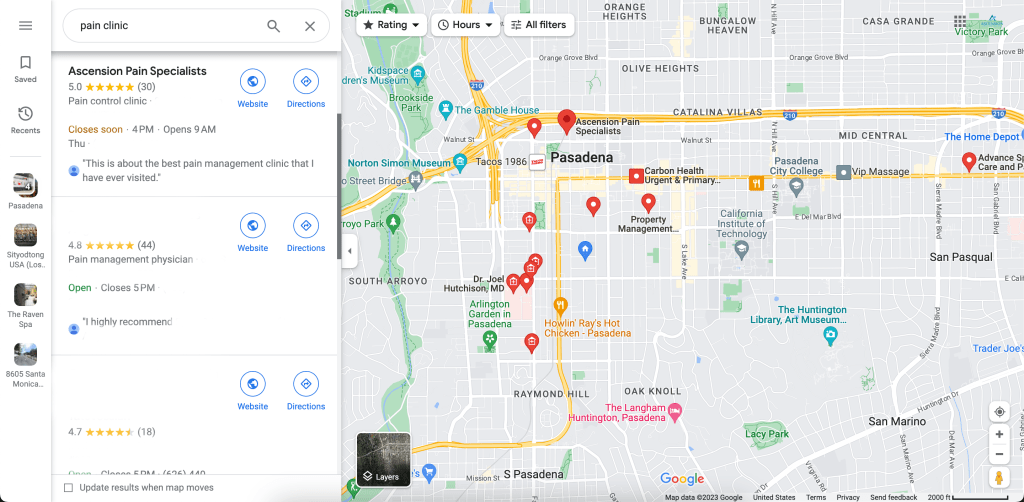

One of the most important part of any business plan is the competitive analysis. There are consulting agencies that will do this for you, but they cost thousands of dollars. I found that using Google Maps to identify the names and locations of my competitors along with the Medicare Physician & Other Practitioner Look-up Tool to look up a competitor’s billing code submissions history to Centers for Medicare & Medicaid Services (CMS) provided everything I needed to estimate what I was up against.

With Google Maps, I gained insightful geographic perspectives on my competitors. I started by pinpointing my competitors’ locations, and observing their proximities to other key establishments such as hospitals, other medical clinics, and freeways. Furthermore, I analyzed the reviews on Google Maps to shed light on my competitors’ strengths and vulnerabilities. Lastly, visual cues like street view images provided hints about their marketing efforts, foot traffic, and storefront aesthetics.

Once I made a list of my main competitors, I used the Medicare Physician & Other Practitioner Look-up Tool to look up what kind of patient volume they had, and extrapolated what opportunities still existed for me as a new entrant. By putting in a competitor’s name and National Provider Identifier (NPI) into this tool, CMS provides you with the number of times a claim with a particular CPT code was submitted in a given year, along with tons of other useful information.

By leveraging free platforms like Google Maps and the Medicare Physician & Other Practitioner Look-up Tool, I developed a spatial understanding of the competition, and gained a detailed understanding of what volume of office visits and procedures they were performing. This strategy was critical to my ability to craft an educated competitive analysis, and ultimately helped me obtain funding from the big banks as part of my overall business plan.

-

Getting a home loan as a physician business owner

Like many millennials, I had a very difficult time finding a home for our family. List prices and availability were already hurdles, but I thought I would at least be able to take advantage of so-called “doctor loans”. However, I was disappointed to find that being a business owner disqualified me from this particular lending product.

Owning a business might mean freedom and autonomy, but when it comes to securing a home loan, entrepreneurs face unique challenges:

1. Variable Income: Unlike salaried workers with predictable earnings, business owners have fluctuating incomes. This unpredictability can concern lenders, who prioritize stability.

2. Complex Financials: Entrepreneurs often claim deductions and reinvest in their business, reducing their taxable income. This can be financially savvy, but it presents a skewed picture to lenders evaluating their ability to repay loans.

3. Higher Risk Profile: Businesses are susceptible to economic changes. If a company falters, it might impact the owner’s ability to maintain mortgage payments, leading lenders to perceive entrepreneurs as riskier borrowers.

4. Debt-to-Income Ratio: Many business owners have substantial initial debts, which can unfavorably influence their debt-to-income ratio, a key factor in loan eligibility.

5. Documentation Overload: The paperwork for business owners can be daunting. Beyond personal financial records, they’re often required to present extensive business documentation, from profit and loss statements to business licenses.

In general, regional banks are more likely to lend to entrepreneurs than big banks, but expect to have to put a down payment of up to 20%. Having the right real estate agent who has good relationships with lenders is key, as there are numerous types of lending products that you may qualify for, like secondary residence mortgages and portfolio loans. At times it feels unfair to have so many extra hurdles to home ownership as a physician business owner, but unless you can pay for a home entirely in cash, you have to play the bank’s games.

-

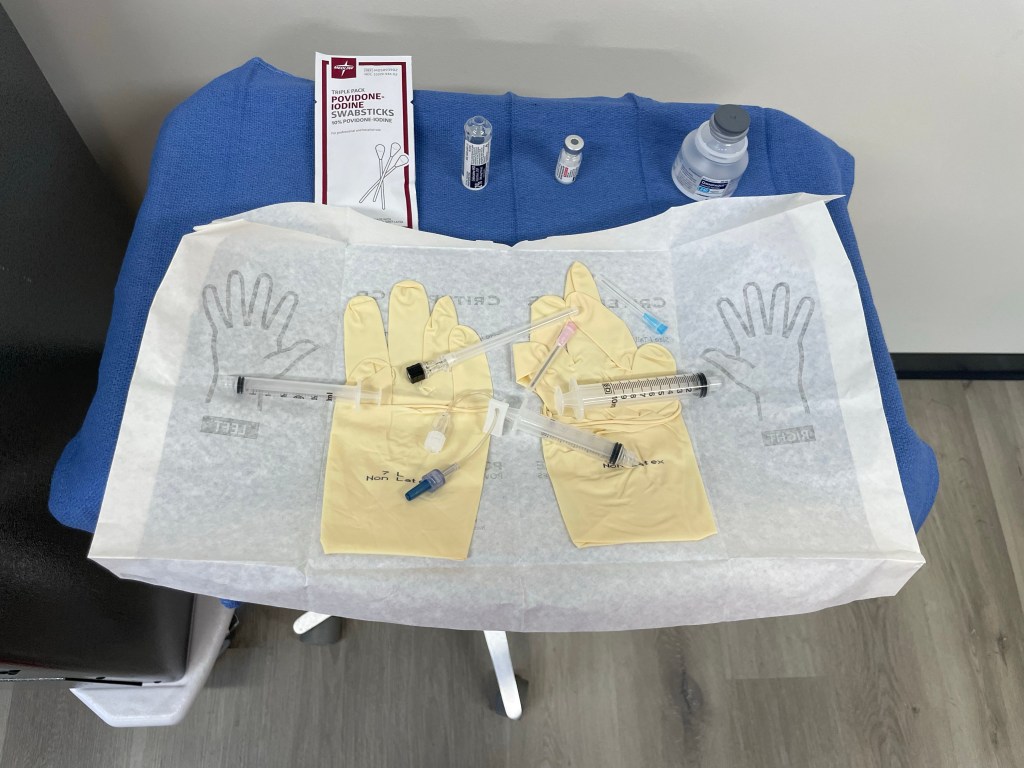

DIY pain management procedure kit

I use the vendor Henry Schein to purchase the majority of the supplies I need to run a private practice, and have had a generally positive experience with them. However, over the past couple of years, certain items that are critical to performing pain management procedures have been difficult to obtain due to “supply chain issues”, including the procedure kits that come with skin cleaning solution, gauze, syringes, needles, local anesthetic, saline, etc. – all the items you need to conveniently and efficiently perform virtually any pain management procedure. Moreover, the prices for the kits that are available have gone up substantially.

To save money and to ensure that I have all the materials I need to perform the most common procedures in pain management (i.e. epidurals, joint injections, nerve blocks), I started to keep track of the minimum materials required and began ordering them individually. I found that the cost of creating my own pain management procedure kit is extremely low, and helps simplify the process of performing certain procedures.

This is everything I needed to perform a recent shoulder joint injection. Here are all of the items included in my DIY pain management procedure kit:

- Criterion CR Polychloroprene Surgical Gloves, size 7.5 ($1.28 per glove)

- Surgical Prep Swabstick PVP Iodine 10% ($0.46 per pack)

- Triamcinolone Acetonide Injection 40mg/mL, 1mL ($7.87 per vial)

- Lidocaine HCl Injection 2% Preservative Free, 5mL ($1.61 per vial)

- Omnipaque Injection 240mg/mL PlusPak Bottle, 50mL ($6.74 per vial)

- Luer Lock Syringe 10cc Clear Low Dead Space ($0.09 per syringe)

- Luer Lock Syringe 5cc Clear Low Dead Space ($0.07 per syringe)

- Luer Lock Syringe 3cc Clear Low Dead Space ($0.05 per syringe)

- IV Extension Set Needleless 6″ Female Luer Lock Adapter ($1.06 per IV extension set)

- Needle 22gx3-1/2″ Quincke Spinal Black ($3.73 per needle)

Excluding the steroid and contrast, my DIY procedure kit costs about $8.35. The simplest kit that I found on Henry Schein costs about the same amount, but doesn’t include the procedure needle. I learned to use the wrapper for the sterile gloves as my sterile field as a resident doing peripheral nerve blocks during my regional anesthesia rotations. Just open the wrapper without touching the inside, and drop all your materials onto it, like in the picture!

In an effort to save even more money, I started following the advice of some of my friends and colleagues who work in academic pain clinics at places such as UCLA and Northwestern University who told me that they temporarily stopped using contrast dye for certain procedures such as lumbar epidural steroid injections and joint injections because there has been a critical shortage of contrast dye. Supply chain constraints have preferentially funneled this drug primarily to cardiology and interventional radiology suites, where contrast dye is also used for more urgent and emergent procedures. The only procedures I would never skip using contrast dye for are cervical epidural steroid injections, and sympathetic nerve blocks.

-

Small business loans for doctors

Before starting my own journey into private practice, I asked my friends and colleagues who had opened private practices of their own how much money I needed to get started. The number that most of them told me was $300,000. I kept this number in mind when I started drafting the business plan that I would use to apply for a small business loan.

When I researched small business loans, I wanted to choose a lender that understood the unique challenges and needs of owning and operating a private medical practice. Any big bank would likely drool at the chance to fund an upstart private practice since doctors are seen as high-earners and able to reliably pay off the loan, sink or swim. However, only two banks offer lending products specifically for healthcare providers: Wells Fargo and US Bank.

After spending months writing up and editing my business plan, I scheduled meetings with both of these banks but had very different experiences with each. I planned to meet with US Bank first, but they forgot about our meeting when I showed up to their local branch. This poor first-impression was lasting for me, and I decided I didn’t want to reschedule with them.

My experience with Wells Fargo Practice Finance division was quite the opposite. My initial meeting took place with the Business Development Manager and associates, whose focus was in healthcare. They were warm in their welcome, went over my business plan with me, asked important questions, and gave me advice on how to get started. Then, they detailed everything I would need to formally apply for the loan. The initial application required the following documents:

- Practice Start-Up Information – details about my proposed private practice (i.e. square-footage, location, payer demographics, staff)

- Personal Financial Statement – details about my personal assets and liabilities (i.e. cash, debt, property ownership)

- Credit Application – credit check

- Beneficial Statement of Ownership – details about my business entity (i.e. S-corporation name, address, EIN)

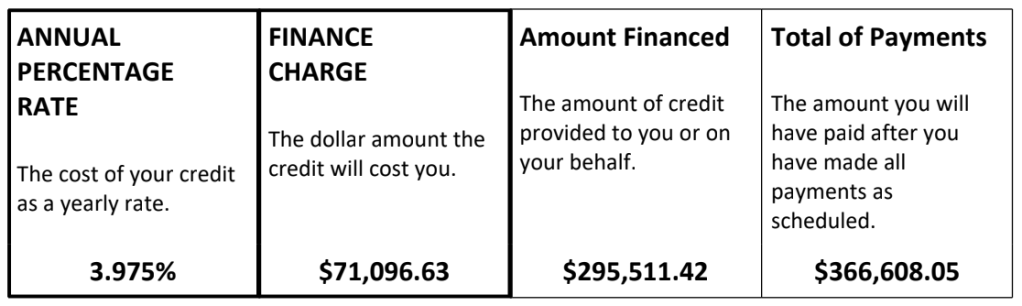

After providing the Wells Fargo practice finance team with additional documents, such as proof of various insurance policies (i.e. life, disability, malpractice, liability, worker’s compensation), I worked with them to breakdown how I would use the funds to pay for rent, specific equipment, salaries, etc. Within two months of starting the application process in January 2021, I was awarded a nearly $300,000 loan with a 10-year term and fixed interest rate of 3.975%.

This loan not only paid for all of the equipment I needed to examine and perform procedures on patients starting day one, but covered all my monthly overhead for almost the entire first year of my private practice’s existence. It allowed me to grow the business without the pressure of needing to be profitable right away. By simultaneously earning money through my work doing anesthesiology and qualified medical evaluator (QME) exams, I was able to comfortably ramp up the clinic volume to a point where I could focus more time and energy on the private practice. As planned, I am now in the fortunate position to start paying off the loan while continuing to grow the practice.

-

Choosing business bank accounts

One of the first accounts I opened for my new business was a business checking account. This account serves as the primary place for me to deposit money earned, and pay for business expenses. I primarily use Chase because I think they have one of the best mobile apps, and I frequently use built-in app features like Zelle to pay for certain services with vendors or freelancers who accept Zelle, and mobile check deposit so I don’t have to go to the ATM or bank to deposit small and large checks.

I have a Wells Fargo business checking account connected to the small business loan that I financed with them in order to make paying off the loan easier, but I don’t use it for my day-to-day transactions.

Once I had my business checking accounts set up, I started researching business credit cards. I didn’t need a card that builds points by traveling, because my main consumer credit card, the American Express Platinum card, does that for me. I wanted cards that give points for spending on specific office expenses or cash-back, and I ended up signing up for the Chase Ink Business Preferred and Capital One Spark 2% Cash Plus cards.

I have the Chase Ink Business Preferred card to earn points by using it to pay for internet, phone, and TV, which I have set on autopay to make sure I maximize the points earned for those categories. I also have the Capital One Spark 2% Cash Plus card, and I find myself using this card more than the Chase Ink Business Preferred card for everyday business expenses because its cash-back perks are straightforward and generous, without category restrictions.

There are a lot of options out there, so do your research! And remember, you can’t open any of these accounts without first setting up a business entity and obtaining an employer identification number (EIN).

-

Setting up a business entity

Going from a salaried, W2-employee to setting up a business can be daunting for a physician. There are several steps required to legally form a business entity recognized by the Internal Revenue Service, and then set up accounts and services to efficiently run the business. Luckily, it’s really not hard to get this done properly and quickly – with the right help.

In order to set up a business, one must create a business entity. At least for physicians, the most common business entities are a limited liability company (LLC) and an S-corporation. Unlike a company, a corporation has “shares” that can be owned by and transferred between shareholders. Because my intention was to open a business with a physical office that might eventually attract partners or even buyers, I decided to elect an S-corporation as opposed to an LLC. I hired an attorney to create my business entity, which I highly recommend. Such legal services typically cost about $2,000 up front, and $500 annually to maintain.

Once I had my S-corporation set up, I had to apply for an employer identification number (EIN) by the IRS. Again, this can be done for you by an attorney. An EIN is required for a business to apply for various types of accounts and services, such as:

• bank accounts

• credit cards

• small business loans

• payroll

• accounting

• corporate tax filingI personally found learning about and choosing the different accounts and services that companies offer one of the most enjoyable parts of setting up a business. Regardless of your choices, these accounts and services are key to maximizing the tax benefits of operating a business. With the right set up and a savvy accountant, physicians can save tens of thousands of dollars in personal income taxes every year. There are a lot of options to choose from, and I will review my choices in future blog posts!

-

Why private practice?

My journey into private practice began unexpectedly and progressed quickly. Coming out of residency and fellowship training, I had what I thought was a stable job as both an anesthesiologist and pain management specialist for a large hospital-based group. My salary was competitive, the work was predictable, and I enjoyed my colleagues.

I considered the possibility that I may want to open a private practice someday, but like many doctors just finishing training, I wanted a job that felt safe to start with. Then, in less than two years of starting this job, the pandemic hit.

Elective surgeries and procedures were cancelled, and suddenly the axiom that being a physician afforded a safe and reliable lifestyle was turned upside down. In early April of 2020, I received an email from my employer stating that my salary would be immediately cut by 30%, and that if I continued to show up to work, I would automatically opt into any new terms set forth by my employer. No addended contract was sent to me for review, and no formal discussions were had with my employer.

And so, in my disgust by this corporate coldness, I decided that I could not work for a company that treated its own physicians this way. In July of 2020, my family and I moved across the country close to where I grew up with the goal to open a private practice within a year. I never could have imagined the challenges that lie ahead of us both professionally and personally, but we’ve been navigating them ever since…

Looking over Los Angeles from atop the Mt. Hollywood trail.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.